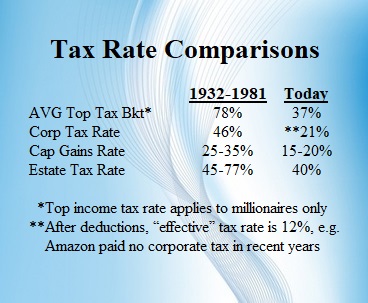

There are countless arguments about budget deficits and not being able to afford things. This was not always the case. We were financially functional from 1932-1981. During this entire 50-year period we did countless wonderful things...with little debt...for the total cost of $1 trillion national debt: We survived a great depression, started social security/GI Bill, won the most horrendous war in world history, built our infrastructure including the interstate highway system, put a man on the moon, fought a losing proxy war with Russia/China in Vietnam, and were winning the cold war. A family could also afford to live on the income from one job. Instead of being financially dysfunctional, THIS WAS NORMAL. FOR FAMILIES AND FOR THE COUNTRY!

Reagan then tried a bold unproven idea called “trickle down” economics. Even HW Bush made fun of it, but here was the idea: If you slash taxes on the rich, they will buy more, start new businesses, and hire more workers, helping the economy. As an independent investment adviser at the time, I know what the wealthy did with their newfound riches. It was easy to slap it into the stock market, or the occasional real estate deal. Most did not start new businesses, because they were already rich, and if there was a way to make even more money they would have already done it.

Reagan slashed taxes on billionaires by 55%. Over the last 40 years, about $20 trillion shifted from fed tax revenues back to the wealthy. I estimate $12 trillion of this went into stocks. And about $6 trillion of it into real estate, causing asset inflation, doubling what should be the RE price now (over and above CPI). One job now won't pay the bills, because housing/rent is twice as high as it should be. The “Reagan Dividend” solution: Any citizen 18 and older receives $700/month if they make < $30K/year. Pay for by renewing some of the taxes on billionaires, most likely with a new yearly wealth tax. A 1% yearly wealth tax on the top 1% ($41 trillion) would more than pay for the estimated $300B/year. This also helps compensate for a dollar that only buys 27% of what it did in 1980. This puts a subsistence income directly into the pockets of the needy (who would also tend to spend it, thereby helping the local economy, instead of putting it into stocks and real estate).

With drastically lower federal tax revenues since Reagan, “trickle down” weakened federal finances/services. Deficits soared, and we now incur $1 trillion more debt EVERY YEAR. Less money went to infrastructure, colleges, and other social programs for 40 years. This dumped social burdens onto the states (who can't print money), who had to raise taxes. And over the last 70 years, TOTAL taxes on the lowest incomes have INCREASED 53%...while taxes on the most wealthy have DECREASED 68%. https://imgur.com/xhYCQh4

Obviously trickle down didn't work. Let's now thank the wealthy for investing this money for us, but now pay lower income people a monthly dividend to compensate for doubled housing costs. We can call it the Reagan Dividend, or Reagan Reparations, "Trickle Up," or MA$GA...Make America Financially Great Again...the name isn't important. If we also returned to the AVERAGE tax rates on the rich from 1932-1981, we could balance the yearly budget AND still have $237B/year for health care, climate change, and debt repayment. Your federal taxes would stay the same if you make less than $400,000/year.

Life:

-

John and Patty can now afford for her to stay home with the kids, and help start their part-time business.

- Dave started trade school immediately after high school, paying his own way.

-

A young couple can finally afford a home.

- John's wife Sylvia now qualifies. They use the extra $700/mo to pay off his college loan.

- Every "housekeeper" gets a raise.

-

Along with working summers and some JC classes, Rene can now afford monthly room/board/tuition at a state college.

-

Heather wants to start her life anew. She can now afford to leave her pimp and move to Seattle.

-

Mike now pays his Aunt Mable $500/month for room/board. She needs the extra income.

-

Now retired, I can again afford the higher rent costs, without dipping into retirement savings.

- Argument about minimum wages end. This increases incomes $4.38/hour. Let states decide on their own minimum wages.

- Local companies see their business increase.

- Begging is no longer necessary, and homelessness plunges.

Notes:

1) Of the $20T, I estimate $6T went into real estate, $12T into stocks, and $2T into toys and a better economy. $6T was enough to pay cash for all new homes built over the last 40 years (1 million per year). But most real estate purchases involve debt, so this was more than enough to severely bid up prices.

2) Soaring college costs are also a result of this housing price bubble. Attendance has doubled over this period, so real estate had to be built to accommodate.

3) “This is socialism!” Was it socialism to the most wealthy, when $20 trillion was sent back to them with slashed taxes? Was it corporate socialism when corporate taxes were slashed from 46% to 21%, and many huge companies now pay almost nothing in taxes? This is simply a correction/reversal from ”trickle down economics.”

4) "This is wealth redistribution!" All the federal government does is receive revenues and redistributes them wisely.

5) With such a huge reduction in Fed tax revenues for 4 decades, much less has been available for social programs that improve peoples' lives, and true “trickle down” to neighborhoods. This has made it necessary for states and communities to raise taxes. Reagan also BEGAN taxation on Social Security benefits. Notice on this interactive chart link that over the last 70 years, TOTAL taxes on the lowest incomes have INCREASED 53%...while taxes on the most wealthy have DECREASED 68%. https://imgur.com/xhYCQh4